YOUR CAPITAL SOURCE

Whatever your business, and no matter your goals, New Market Funding is here for you

Industries Served

With a comprehensive background in construction, we’ve transferred our skills across industries. From manufacturing to retail, we understand the buying, selling and distribution of goods and services. Our team is ready to meet you where you are and to learn where you want to go to better assist you in targeting the funds that will take you there.

Below are a list of industries we have worked with in the past. Our network of lenders goes deep in each industry, and we are here to help you access, pitch and close the deals you need for your next step.

Construction

Guarantee a designated total sum for construction of your project, but roll out funds as each phase of production is completed and verified . Manage your total debt and interest load during the life of the project through a construction loan.

With our background in construction and custom home installs, New Market Funding has the background and experience to help you get the most out of your construction loan. We will help you position your ask tailored to your detailed production plan as part of a comprehensive business plan. Take your construction project to the next level of refinement with New Market Funding.

Real Estate Developers

From office towers and industrial parks to convenience stores, main street retrofits, boutiques and shopping centers, commercial real estate is at the heart of an active local economy. With a background in construction, we know the flow of business in this sector. We’ve seen the work in terms of what it takes to get done. That makes New Market Funding an ideal partner as you seek funding to build your next project.

From blueprints to concrete, framing, water, sewer, electric, data, roofing and finishing, we’ve seen it all. When you need a “boots on the ground” team who can tell you what your plan is going to cost, beyond industry benchmarks and averages to permits, materials, time, and labor, we can understand your objectives and help you to translate your development plan into a funded scope of work.

Contractors

Contractors are the lifeblood of the construction industry. From home maintenance and repair to the specialized skills required to complete new construction, contractors make it happen on time and to budget, yet contractors also carry a lot of financial responsibility: day labor, hourly contracted skilled workers, covering invoices with on time payment, not to mention vehicles, tools and equipment.

New Market Funding has the experience and connections to help your cash flow in order to complete jobs from the smallest home remodel to the largest construction site your area has to offer.

Health Care & Medical

Clinics, laboratories and hospitals require specialized high value equipment, technology and facilities. Many of these items leased or are paid off over 10, 15 or even 30 years in order for the presiding physicians to demonstrate profitability in the near term. Before you jump into a financing option proposed by a manufacturer, check with New Market Financing to find out if there are more favorable terms, or if a different approach to leasing or financing can provide you better cash flow.

Manufacturers

From craft work to bottling, machining, chemical production and more, manufacturers are an ever more important reemerging part of the US landscape. With manufacturing comes the need for important financial structures such as invoice factoring to smooth out cash flow, leasing for machinery and equipment and operating lines of credit to give you flexibility in your everyday operations.

Restauranteurs

Restaurants are one of the most challenging industries in the market. From supply chain to menu development, ambiance, table turnover rate and staffing, there’s a lot to juggle. Thankfully, our network of investors has the experience in the industry to see what can not only succeed, but thrive. When you need funds to conduct leasehold improvements, acquire industrial equipment, market and meet payroll, New Market Funding can connect you with the right lender.

Hotelliers

Many investors or investment groups have great opportunities in the flagship hotel business. From acquisition, value add and sale to new development and owner/operator businesses, there are numerous opportunities in this dynamic industry.

From hard money acquisition funds to take immediate possession of a property to construction loans and long-term financing New Market Funding has options to help your hotel business expand.

ACDBE & DBE:

Airport Disadvantaged Business Enterprises are entitled to unique opportunities to compete for service contracts and to receive federal funds. Additionally, businesses in targeted government contracts. To become competitive, businesses need to demonstrate the capacity to complete jobs on time, to spec, and within industry best practices. Sometimes that means access to the funds necessary to complete larger projects. Businesses can start their conversation with lenders in advance of bidding jobs to see what funds are available to them.

Let us know about your business and financing objectives.

New Market Financing

25550 Grand River Avenue

Redford, MI 48240

e. info@newmarketfunding.com

ph. 855-215-6092

Commercial & Industrial

Industrial businesses that deal in raw materials or that work in custom manufacturing often deal in large volumes or high cost valuable materials. Invoice financing is a primary mechanism to access the materials at the right time and the right price to keep goods and services moving.

Heavy equipment leasing, equipment financing and invoice factoring are other means to keep cash available on hand instead of tied up in items that are on an unsatisfying depreciation schedule.

Keep money moving so business managers have the funds available to stay focused on the art of the deal.

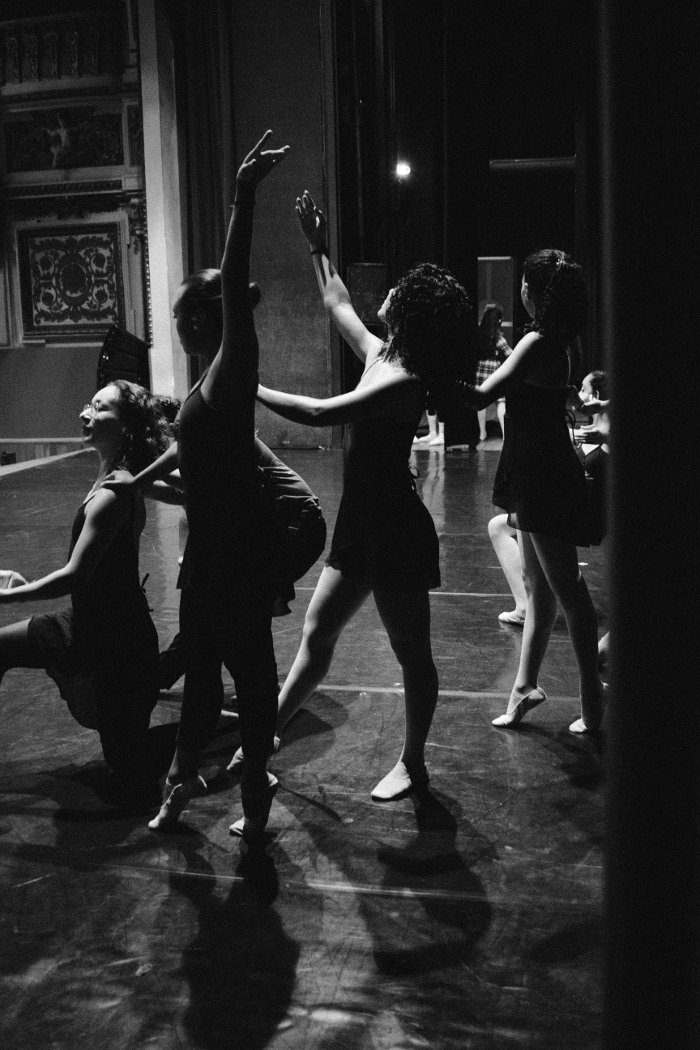

Charter Schools

Charter schools are a part of many communitie’s future growth plan. From schools for the arts to science and engineering STEM incubators, and programs that help kids at risk grow and thrive – there’s no way around it. Charter schools are a major part of our communities.

When charter schools are ready to grow they often have more prospective students than capacity allows. When this occurs, charter school loans are a good option to access funds for space, computers, technology, dance studios, musical instruments and more.

Nonprofit

Nonprofits have a number of ways to fund development, acquisition and operational costs. In some instances, a capital fundraising effort is necessary, but, like businesses, funds raised don’t necessarily need to pay off a whole project in one fell swoop. Funding can be a multi-year effort, and with an initial down payment, or with leverage against existing assets, many nonprofits can expand operations without a call for donations an overt campaign.

While many nonprofits are service and customer based, many are also simply organizations built around service to members. As service expands, so do the pressures on operational funds. Yet, many organizations don’t know they can leverage the same assets as any business.

SBA 8a Businesses and Partnerships

Participants in the SBA 8a business program have access to training, mentoring, bids for government contracts, and, as importantly, loans , to support growth and development of your business operations. Whether you have sought funding before or not, now is your opportunity to expand operations and access the funds you need to grow.

New to the program? Visit the SBA 8a website online to learn about qualifications, the application process, and available resources.

Churches

Many people don’t think of loans when they look for funding to grow, develop, ad programs or refurbish a physical building. Maybe your church has a committed congregation, but no single donors with deep pockets.

If you have positive cash flow and can demonstrate the commitment of your board of directors and congregation, seeking loans for specific purposes may be an ideal answer to your prayers.

Big banks may not have a lot of faith, but that doesn’t mean there aren’t lenders who understand the path a church must take to grow its flock.

A loan is not a miracle, but it can help you carry your message out into the community.

Franchisees

Many franchisees believe they must save the entire startup fee before beginning their business. In many cases, with 10% down a franchisee can acquire an SBA franchise loan or private loan to begin operations and to save cash for other operating costs. Pay down your franchise launch or acquisition as you opperate.

Let us know about your business and financing objectives.

New Market Commercial Funding

25550 Grand River Avenue

Redford, MI 48240

info@newmarketfunding.com

855-215-6092

Get Started